Investors showed a preference for index trackers in most equity sectors in the first quarter of the year, according to data from FE Analytics.

In the below study, we have looked into the most bought and sold funds in the first three months of 2024 across the different equity sectors of the Investment Association. We have focused specifically on funds where investors added or withdrew at least £100m.

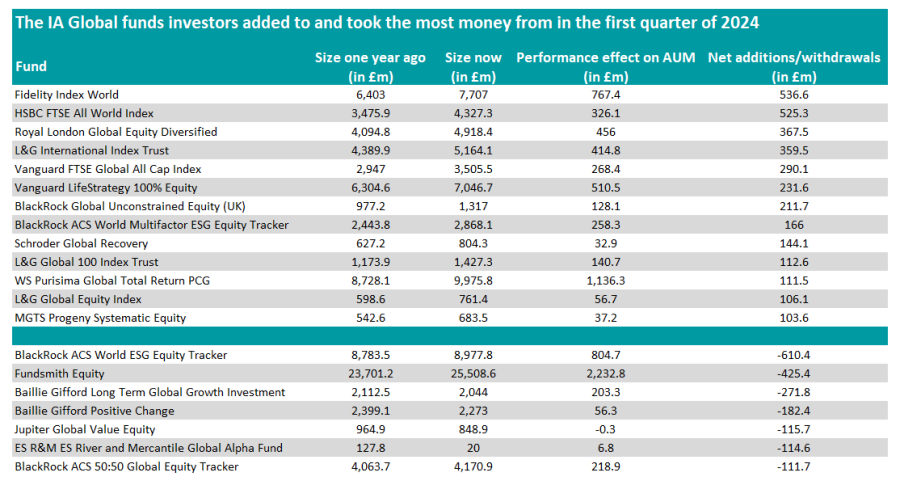

In the IA Global sector, investors took out £425.4m from Fundsmith Equity, although the fund was still able to grow thanks to performance, which added more than £2bn to its assets under management.

The £25.3bn portfolio has fallen out of favour with investors in recent years, as it was the most sold fund in 2023. While Fundsmith Equity has delivered a positive return over the past year, it has, however, lagged its sector. It also failed to beat the MSCI World index over five and three years as well as over the past 12 months. As a result, Bestinvest recently added the portfolio to its list of ‘dog funds’ for the first time ever.

Other growth funds appear among the most sold global portfolios, such as Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Positive Change, which shed respectively £271.8m and £182.4m.

Yet, value funds were not the beneficiaries of this disenchantment for growth strategies, as investors sold Jupiter Global Value to the tune of £115.7m. A reason for this sell off might be the departure of Ben Whitmore who had been managing the fund since its inception in 2018. He is in discussions to keep the fund under his new asset management firm, however.

Source: FE Analytics

Instead, investors favoured passive funds for their exposure to global equities, with Fidelity Index World, HSBC FTSE All World Index and L&G International Index Trust attracting the most inflows.

Royal London Global Equity Diversified, BlackRock Global Unconstrained Equity (UK) and Schroder Global Recovery were the only active strategies that received at least £100m of inflows.

In the IA Global Equity Income sector, Royal London Global Equity Income is the only portfolio in which investors added at least £100m, as they poured £273.5m into it. The other way around, Fidelity Global Dividend and BNY Mellon Global Income shed £613.3m and £ 176.7m respectively.

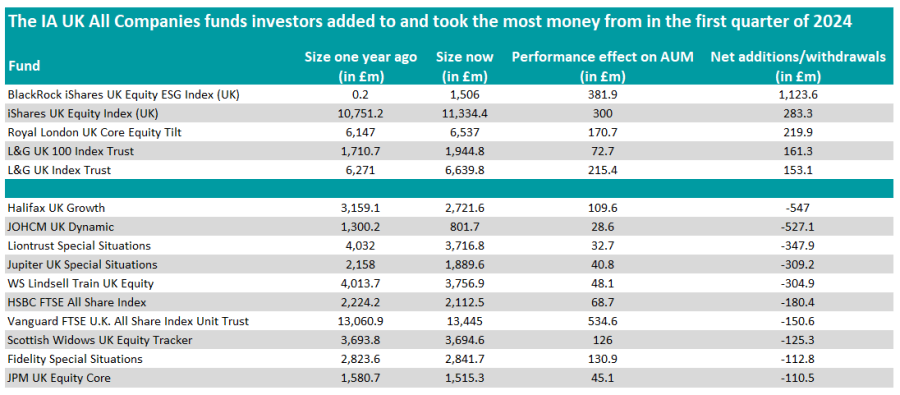

Fund flows in the IA UK All Companies sector followed a similar pattern, with investors backing passive funds such as BlackRock iShares UK Equity ESG Index (UK), iShares UK Equity Index (UK) and Royal London UK Core Equity Tilt.

Similar to the IA Global sector, investors shunned active funds, regardless of their style bias. For instance, they withdrew more than £300m from growth-oriented strategies Liontrust Special Situations and WS Lindsell Train UK Equity. The latter fund had a disappointing start in 2024, as it is down 1.7% since the beginning of the year.

Source: FE Analytics

However, investors also steered clear of value funds, as JOHCM UK Dynamic, whose manager is heading to replace Whitmore at Jupiter, and Jupiter UK Special Situations – another Whitmore fund – also shed more than £300m.

In the IA UK Equity Income sector, investors poured £117.6m into BlackRock UK Income and withdrew £263.8m from Jupiter Income Trust and £162.7m from CT UK Equity Income.

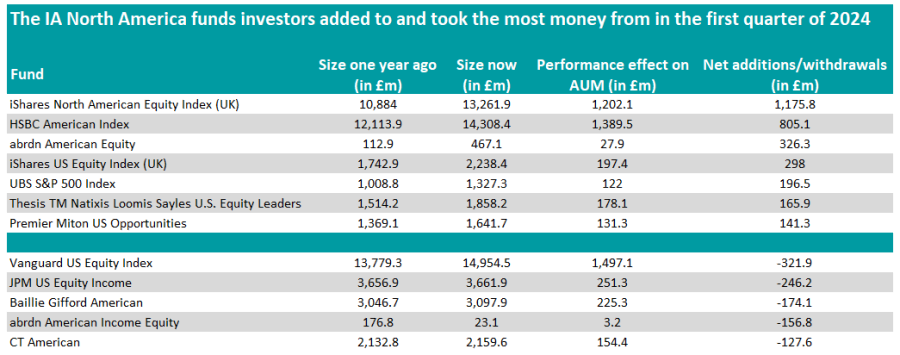

In the US, investors added money into trackers such as iShares North American Equity Index (UK) and HSBC American Index but also bought actively-managed funds, including abrdn American Equity, Thesis TM Natixis Loomis Sayles U.S. Equity Leaders and Premier Miton US Opportunities.

Source: FE Analytics

Meanwhile, Vanguard US Equity Index is the fund in the IA North America sector that experienced the most outflows, followed by JPM US Equity Income and Baillie Gifford American.

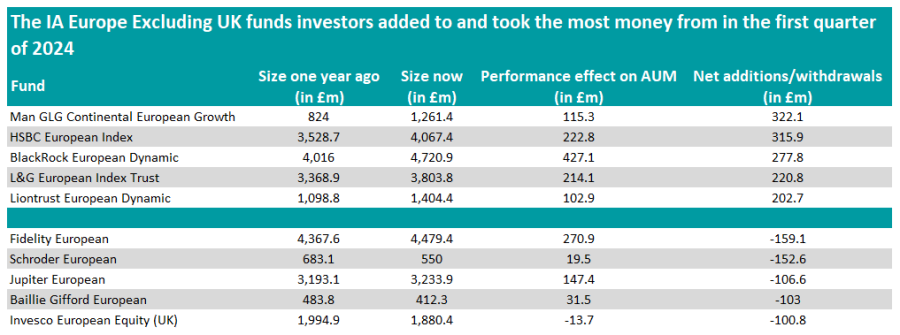

In Europe, an active fund – Man GLG Continental European Growth – received the most money from investors, while they also backed BlackRock European Dynamic and Liontrust European Dynamic. Among passive funds, HSBC European Index and L&G European Index Trust were the most popular options.

Source: FE Analytics

However, only active funds experienced outflows in excess of £100m, with Fidelity European being the most affected.

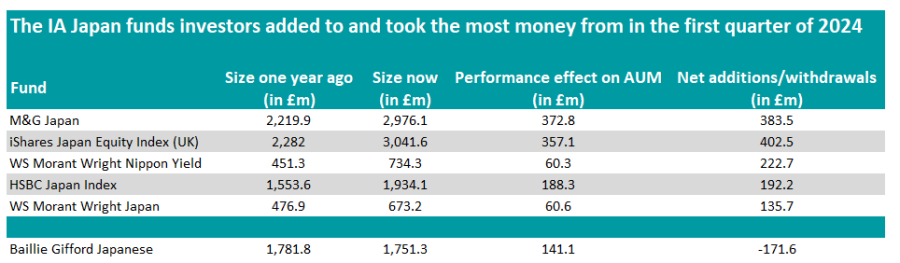

Investors also favoured active funds in Japan. They backed two funds from Morant Wright – WS Morant Wright Nippon Yield and WS Morant Wright Japan – as well as M&G Japan which received ¥73,826.68m (£383.5m) of inflows and index trackers such as iShares Japan Equity Index (UK) and HSBC Japan Index.

Source: FE Analytics

Baillie Gifford Japanese was the only fund in the IA Japan sector from which investors withdrew more than £100m.

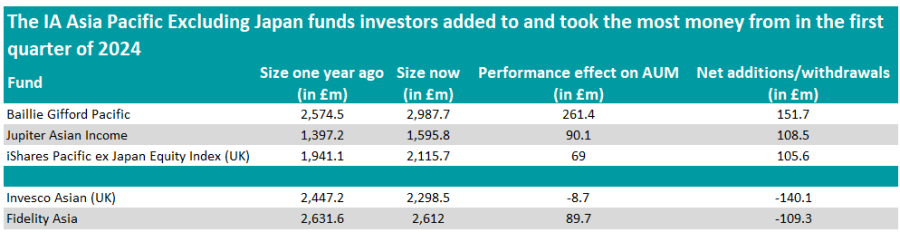

However, its stablemate Baillie Gifford Pacific was the most popular option in the IA Asia Pacific Excluding Japan sector, with investors buying £151.7m worth of units.

Jupiter Asian Income came second in terms of inflows, as it received £108.5m from investors. The fund is known for shunning Chinese stocks while Australia is its largest country weight, with manager Jason Pidcock recently explaining that investors are “too lazy” to look at the country.

iShares Pacific ex Japan Equity Index (UK) was the only passive fund to receive more than £100m of inflows in the first quarter of the year.

Source: FE Analytics

On the other side of the spectrum, Invesco Asian (UK) and Fidelity Asia were the most sold funds in the sector.

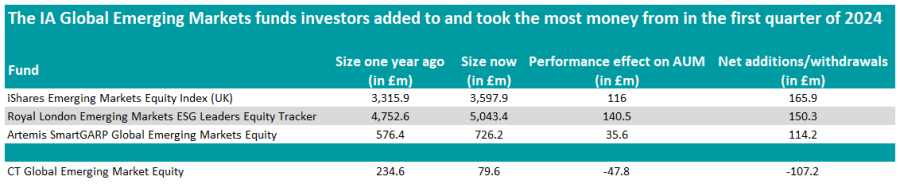

In the IA Global Emerging Markets sector, investors backed tracker funds iShares Emerging Markets Equity Index (UK) and Royal London Emerging Markets ESG Leaders Equity Tracker, whereas Artemis SmartGARP Global Emerging Markets Equity was the only active fund to attract at least £100m worth of inflows.

With outflows of £107.2m, CT Global Emerging Market Equity was the most sold fund in the sector.

Source: FE Analytics

Elsewhere, investors poured £246.5m into Jupiter India, which was one of the most bought funds on the Hargreaves Lansdown and Fidelity platforms in January. Although Indian equities are gaining in popularity in the UK, experts have warned of a potential correction after last year’s rally.

L&G Global Technology Index Trust and L&G Global Health & Pharmaceuticals Index Trust also received £203.1m and £110.6m respectively in the same period.

Although technology has benefited from the artificial intelligence hype in recent times, the healthcare sector has made more modest returns since the Covid rally. Yet, it is one of the few ‘unloved’ areas wealth management firm Canaccord likes, as it is exposed to long-term structural tailwinds.

Finally, investors took out £153.2m from IA Specialist constituent Stewart Investors Asia Pacific Leaders Sustainability.